Blockchain

3 months ago

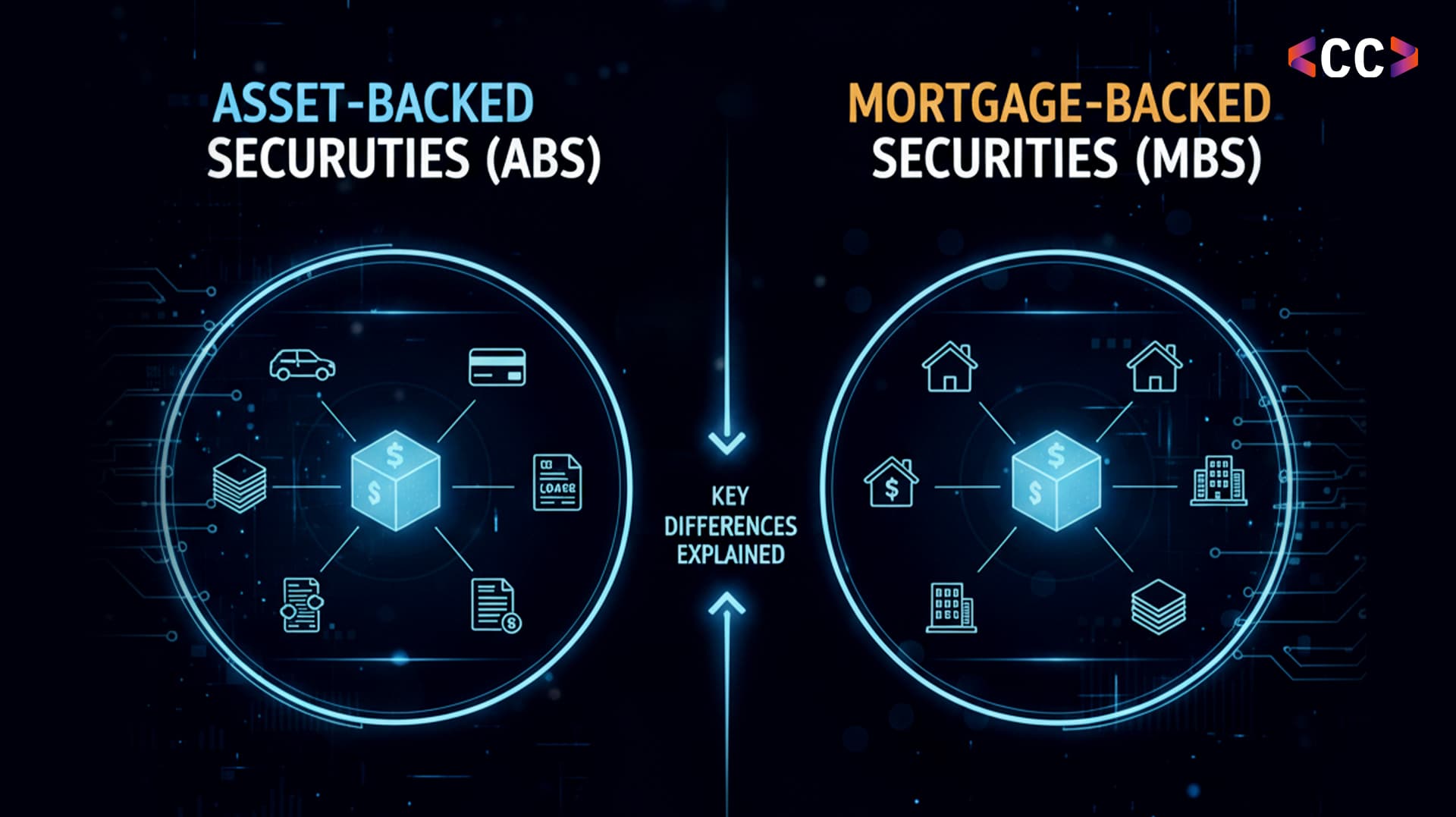

Asset-Backed Securities (ABS) vs. Mortgage-Backed Securities (MBS): Key Differences Explained

Understanding Structured Finance Instruments

Asset-backed securities (ABS) and mortgage-backed securities (MBS) are two types of structured financial instruments that transform pools of income-generating assets into tradable investments. Both play a critical role in modern financial markets, offering investors steady returns while enabling lenders to free up capital for further lending. Although they share similarities, ABS and MBS differ fundamentally in their underlying assets, risk profiles, and sensitivity to market fluctuations.

What Are Asset-Backed Securities (ABS)?

Asset-backed securities (ABS) are investment products backed by pools of non-mortgage assets such as credit card receivables, auto loans, student loans, or equipment leases. In essence, financial institutions bundle these assets, securitize them, and sell portions to investors. Investors then receive scheduled payments drawn from the underlying loans or receivables.

Key Features of ABS:

- Collateral Type: Non-mortgage assets like loans or leases

- Issuer: Often banks or financial institutions seeking liquidity

- Benefits: Portfolio diversification, higher yields, and flexibility in asset type

- Risks: Credit risk (default by borrowers) and economic instability affecting loan repayments

ABS are known for their flexibility and diversity, catering to investors seeking higher returns through exposure to various consumer and corporate loans.

What Are Mortgage-Backed Securities (MBS)?

Mortgage-backed securities (MBS) are a specific type of ABS where the underlying assets are home or commercial mortgages. Lenders combine multiple mortgage loans and sell them as securities to investors, with the borrowers’ monthly principal and interest payments serving as investor income.

Key Features of MBS:

- Collateral Type: Residential or commercial mortgages

- Issuer: Often government-sponsored enterprises (GSEs) like Fannie Mae, Freddie Mac, or private institutions

- Benefits: Stability from government-backed issuances and regular income streams

- Risks: Prepayment and interest rate fluctuations (borrowers refinancing when rates drop can impact returns)

MBS play a crucial role in supporting housing finance and liquidity in the mortgage market, aligning investor interests with mortgage lending institutions.

ABS vs. MBS: A Detailed Comparison

| Aspect | Asset-Backed Securities (ABS) | Mortgage-Backed Securities (MBS) |

| Underlying Assets | Non-mortgage assets (auto loans, student loans, credit card receivables) | Residential or commercial mortgage loans |

| Market Dependency | Depends on consumer credit and non-housing asset performance | Tied directly to real estate and housing market cycles |

| Issuer | Banks, credit card companies, and corporations | Banks, government agencies, and private issuers |

| Risk Profile | Credit risk due to borrower defaults | Prepayment and interest rate risk |

| Yield Potential | Typically higher due to diversification and increased risk | Moderate yield with steady cash flow |

| Government Backing | Rarely government-backed | Often supported by government-sponsored entities (GSEs) |

| Investor Appeal | Suitable for investors seeking diversification | Ideal for investors seeking housing market exposure |

The Role of Collateral and Market Impact

Collateral quality is the backbone of both securities. MBS returns rely heavily on mortgage payment consistency and housing market trends, while ABS depend on consumer repayment of underlying debts. During economic downturns, both markets may face rising defaults, but ABS performance can vary widely depending on asset class exposure.

Choosing the Right Investment: ABS or MBS?

The choice between ABS and MBS depends largely on an investor’s risk tolerance and market outlook:

- ABS may appeal to those seeking higher yields and diversification across industries like automotive or education finance.

- MBS attracts investors preferring relatively stable cash flows backed by real estate and, in some cases, government guarantees.

Institutional investors often blend both securities to balance yield and stability.

Leveraging Technology and Expertise in Structured Finance

Understanding the nuances between ABS and MBS helps investors, institutions, and policymakers optimize investment strategies and manage risk effectively. As financial markets evolve, technological innovations—such as blockchain—are enhancing transparency, traceability, and trust in the securitization process.

Organizations exploring blockchain-based securitization or digital asset management can benefit from expertise offered by technology consultancies like ChainCode Consulting LLP, which provides secure and scalable blockchain solutions tailored to fintech and asset management sectors.