Blockchain

2 years ago

Revamping The Financial System: 6 Game-Changing Use Cases Of Enterprise Blockchain In Finance

What do we expect from our financial systems?

Security, fast transactions, and lower charges. These are not only the top three expectations of every customer but also the priorities of every banking institution.

However, when we look at our present-day financial infrastructure, we only get disappointed. The existing financial system is full of inefficiencies like lengthy documentation processes, slower transactions, and high charges. To make it worse, frequent data breaches put the funds and data of people at risk.

What is the solution?

The simple solution to make our financial system more efficient is to decentralize it. Blockchain can enhance the performance and efficiency of our financial system by eliminating the central authority.

Enterprise blockchain in finance helps to bring transparency and establish trust in the processes. Moreover, blockchain also enables faster payments and low-cost transactions. With features like data immutability and programmability, blockchain is here to streamline our financial services.

That’s not all! With the help of smart contracts, blockchain can help bring automation to financial processes. Smart contracts simplify complex financial services by automating the entire process digitally.

To sum up, enterprise blockchain solutions will help to transform the financial landscape for good by creating a decentralized financial ecosystem. Overall, Defi is pushing us towards a more efficient, structured, accessible and affordable financial system.

But how can blockchain technology do so? What are the areas in which blockchain can improve the financial sector?

Let’s find out in this blog.

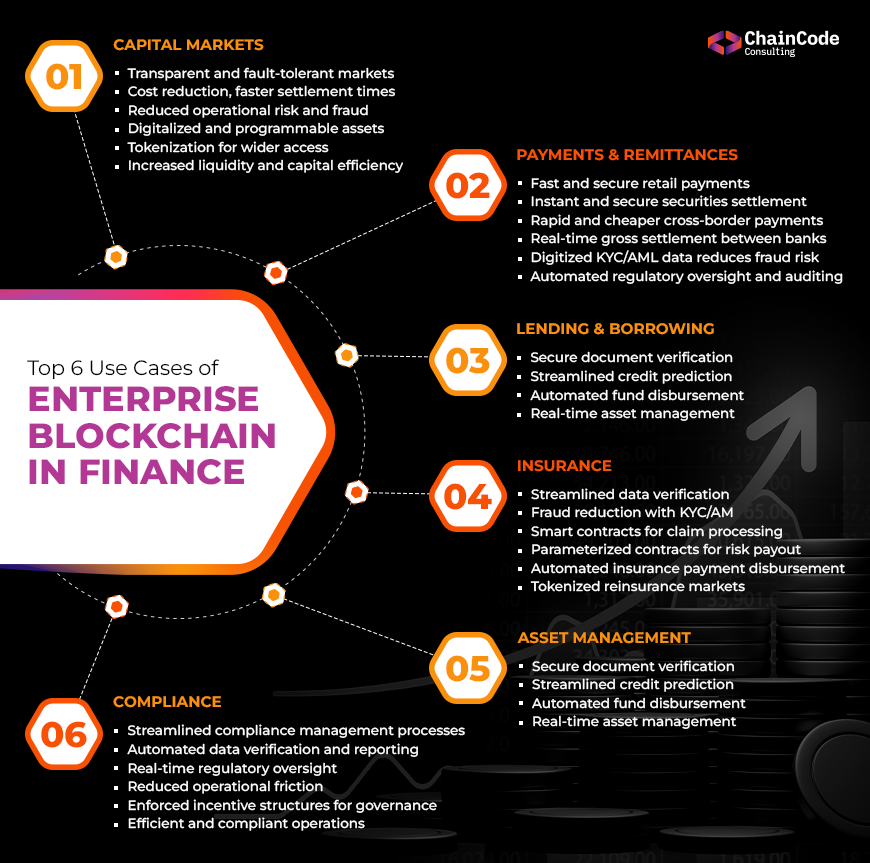

Top 6 Use Cases Of Enterprise Blockchain In Finance

Blockchain in finance has immense scope to revolutionize its services and boost performance. Here are the top 6 uses cases of blockchain in the banking sector.

Capital Markets

A capital market is a place where entrepreneurs, startups, and large organizations meet with investors to raise capital. However, this process is not always a walk in the park.

With increasingly stringent regulations, longer times to get to market, and volatile interest rates, firms face many challenges. Particularly in emerging markets, they have to navigate the lack of rigorous monitoring, thorough regulation, and sufficient market infrastructure for issuing, settlement, clearing, and trading.

But wait, there’s hope! Enter blockchain technology.

Blockchain has been touted as a game-changer for many industries, and capital markets are no exception.

Here is what blockchain can do in the capital markets:

- Eliminate a single point of failure and increases transparency

- Streamlines capital market activities, reduces costs and decreases settlement times

- Digitalize processes and workflows, reducing operational risks of fraud, human error, and overall counterparty risk.

- Assets and financial instruments can also be digitalized or tokenized, making them programmable and much easier to manage and trade.

- With tokenization, assets gain wider market access through increased connectivity and the possibility of fractionalized ownership. This results in increased liquidity and decreased cost of capital.

Payments & Remittances

We’ve all been there – sending money to a friend or family member in another country, only to be hit with high fees and a lengthy settlement process. It’s frustrating and expensive.

Did you know that on average, it costs 6.94% to send $200 between countries, taking 2 to 7 days to settle? That’s a lot of time and money wasted.

But there’s a solution – blockchain technology. By eliminating the need for intermediaries and streamlining payment and remittance processes, blockchain can significantly reduce settlement times and costs.

Imagine sending money to your loved ones with just a few clicks, with almost zero fees and near-instant settlement times. That’s the power of blockchain.

Blockchain in finance allows:

- Fast and secure domestic retail payments

- Instant and secure domestic wholesale and securities settlement

- Rapid, secure and cheaper cross-border payments

- Real-time gross settlement between central banks, commercial banks, and independent banks

- Digitized KYC/AML data and transaction history, reducing risks of fraud and enabling real-time authentication

- Automated regulatory oversight and auditing

Asset Management

Venture capital firms, private equity firms, real estate funds, and speciality markets are facing increasing demands to improve liability risk management, adapt more dynamic decision-making structures, and address the complexity of ever-changing regulations.

Blockchain can effectively streamline asset and stakeholder management, by allowing:

- Automated fund launches and seamless stakeholder engagement with digitized assets and services

- Digitization of portfolios and existing holdings for wider market access, liquidity, and fractionalization

- Customizable built-in privacy settings for transaction confidentiality

- Programmed voting and other shareholder rights for seamless user experience and reduced risks of human error.

- Creation and enforcement of incentive mechanisms to promote participation and punish nefarious activity

- Improving governance and transparency for investors and stakeholders.

Lending & Borrowing

Are you tired of waiting 30 to 60 days to secure a mortgage or 60 to 90 days for a business loan?

Well, we’ve got some good news for you!

Blockchain technology can streamline banking and lending services, reducing counterparty risk and decreasing issuance and settlement times.

Core banking comprises transaction, loan, mortgage, and payment services. Many of these services depend on legacy processes of execution. However, with its ability to streamline processes, reduce counterparty risk, and decrease issuance and settlement times, blockchain is changing the game in banking and lending services.

It allows:

- Authenticated documentation and KYC/AML data can be easily verified, reducing operational risks and enabling real-time verification of financial documents.

- Credit prediction and credit scoring markets can also be streamlined, and instantaneously informed by the collation of user activity and sanctioned data across a network.

- Automate syndicate formation, underwriting, and disbursement of funds, including principal and interest payments, reducing cost, delay, and friction of syndication.

- Facilitated collateralization of assets for real-time asset management, tracking, and enforcement of regulatory controls.

Insurance

Property and casualty insurance claims can be a nightmare for both the insurer and the insured. Fraudulent claims, lengthy assessment processes, and delayed disbursement of payments can make the process frustrating for all parties involved. But blockchain technology has the potential to transform the insurance industry.

Here is how blockchain is making the insurance model efficient.

- With blockchain, data verification, claims processing, and disbursement can be securely streamlined, significantly reducing processing time.

- The use of authenticated documentation and KYC/AML data reduces the risk of fraud and facilitates claim assessments.

- Smart contracts are used to automate claims processing, ensuring a more efficient and accurate assessment of claims.

- Automated parameterized contracts can also be implemented to pay out upon the occurrence of certain risks, eliminating the need for lengthy negotiations and streamlining the payment process.

- Further, with automated disbursement of insurance payments, insured parties can receive their payments on time.

- Lastly, blockchain can also create tokenized reinsurance markets, which can facilitate policy reinsurance in open marketplaces, stepping away from the traditional broker and relationship-based systems. This allows for more transparency, efficiency, and accessibility in the reinsurance process.

Compliance

Regulatory compliance has always been a crucial aspect of the financial industry. But with the increase in cross-border operations and complexity in regulations, keeping up with the pace of regulatory change has become a huge challenge for firms.

This is where blockchain can play a vital role.

How can blockchain help banks in compliance management?

- With its unique governance and compliance attributes, blockchain can streamline processes, automate data verification and reporting, and facilitate regulatory oversight in real time.

- Further, it eliminates the errors associated with manual auditing and other activities, reducing operational friction.

- Additionally, blockchain can create and enforce incentive structures to improve network governance, promoting regulatory compliance and accountability.

- Lastly, with blockchain, firms can ensure that they respect laws, rules, and regulations applicable to their activities, and gain a competitive edge by being compliant and efficient at the same time.

Conclusion

According to a Jupiter Research report, banks could potentially save $27 billion on cross-border payments by utilizing enterprise blockchain solutions.

Furthermore, KPMG’s report indicates that implementing blockchain in finance could reduce errors by up to 95%, increase efficiency by 40%, and decrease capital consumption by up to 75%.

The global blockchain market in the financial sector was valued at $1.89 billion, with The Business Research Company forecasting an annual CAGR of 62.1% growth.

As the adoption of enterprise blockchain in finance continues to rise, it has the potential to offer a more streamlined, efficient, and high-performing system that can meet the demands of this tech-savvy world.